How to Trade Inside Bars

Have you ever noticed how price sometimes takes a breath mid-move, carving out a candlestick that fits entirely within the high-low range of the one before it?

Hey Prop Traders, here’s are some valuable tips, terms explained and prop firm news for July 3, 2025

✂️ BEST JULY PROP FIRM DISCOUNTS

📈 PASS THE PROP TRADING TIPS

How to Trade Inside Bar Candles

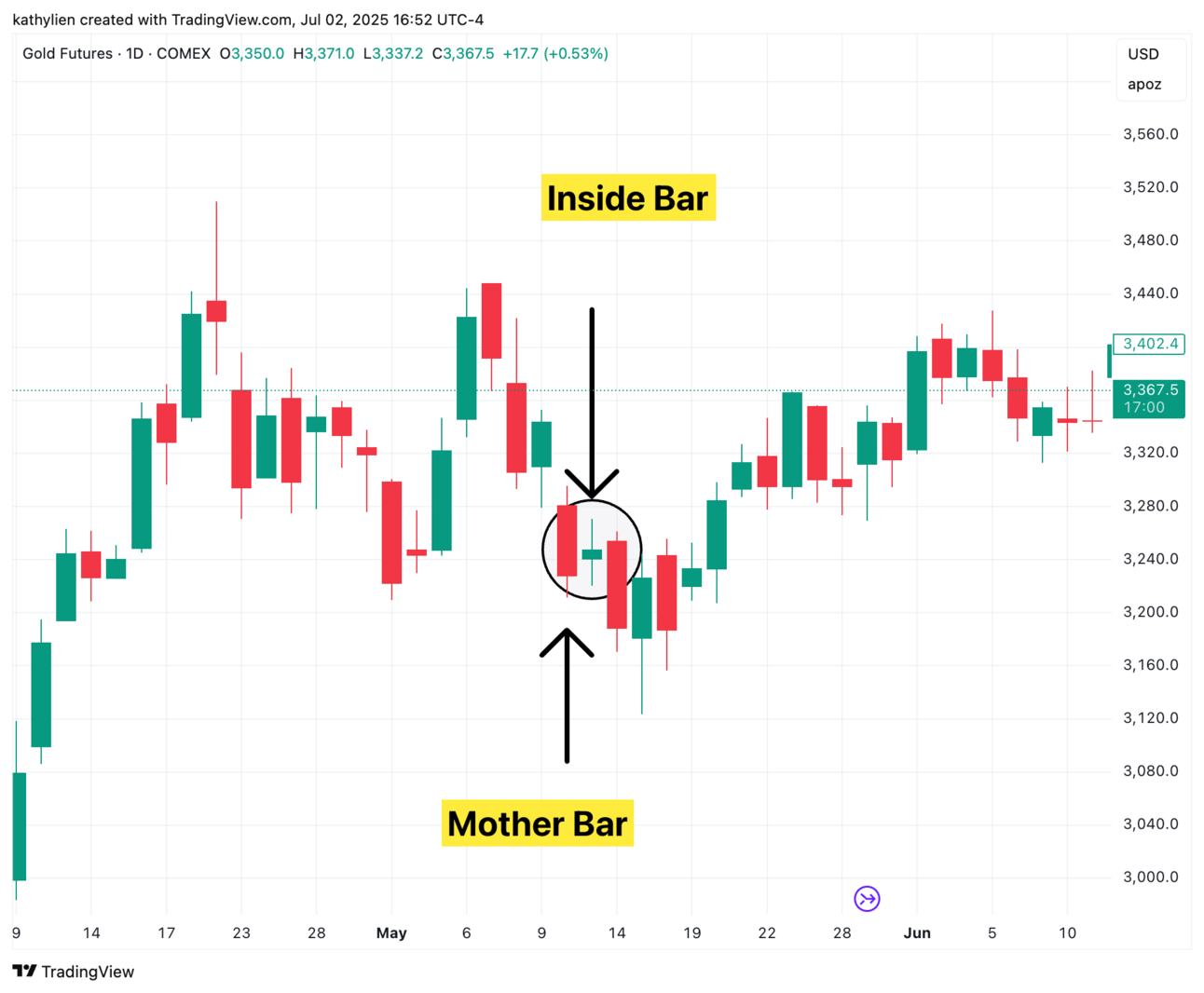

Have you ever noticed how price sometimes takes a breath mid-move, carving out a candlestick that fits entirely within the high-low range of the one before it? That pattern is called an inside bar, and the larger candlestick that contains it is known as the mother bar. When the inside bar’s high is lower than the mother bar’s high and its low is higher than the mother bar’s low, it reflects a temporary stalemate between buyers and sellers—a pause in momentum that can show up on anything from one-minute Forex charts to monthly stock charts.

Traders love inside bars for their simplicity and clarity. They neatly capture genuine consolidation without the need for fancy indicators, compressing volatility into a tight coil that often precedes a sharp expansion—much like winding a spring before it releases. Sometimes you’ll see two, three, or even more inside bars in a row inside the same mother bar; this “coiling” pattern tends to produce especially powerful breakouts when price finally escapes the mother bar’s boundaries.

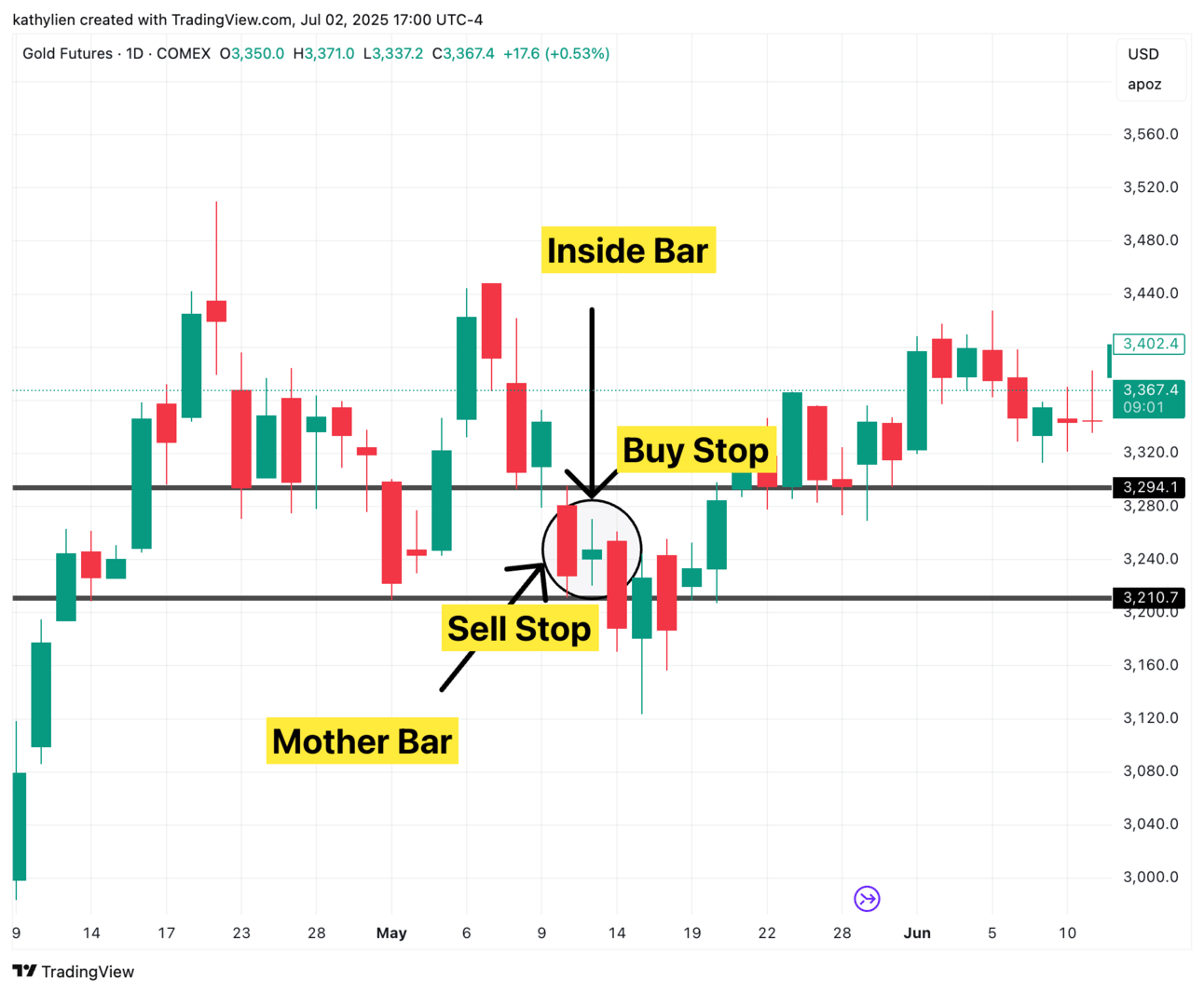

One of the best things about inside bars is that the mother bar gives you both your entry trigger and your risk limits before you ever place a trade. In an uptrend, you simply place a buy stop just above the mother bar’s high; if price closes above that level, you’re boarding the fresh momentum. Your stop-loss goes just below the mother bar’s low, so you know exactly how much you’re risking. In a downtrend, you flip those rules—short below the mother bar’s low, stop just above its high. The following gold chart shows an example of where the buy and sell stops would be placed. For reversal plays, watch for an inside bar at key support or resistance: a break back through the mother bar counter to the prevailing trend can signal a real change in sentiment.

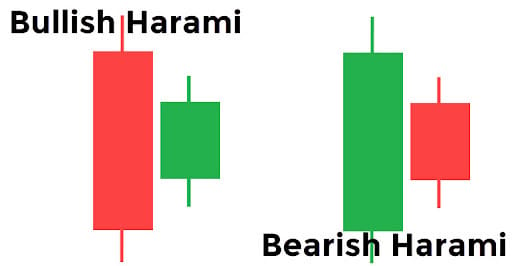

Inside bars also pair beautifully with classic two-bar reversal patterns called harami. A bearish harami starts with a strong bullish candle followed by a smaller bearish candle trapped inside its predecessor—hinting that buyers may be running out of steam. If that second candle is a doji (opening and closing at almost the same price), it’s called a bearish harami cross, reflecting even deeper indecision before a potential downturn. Conversely, in a downtrend you’ll see a bullish harami when a small bullish candle nests inside a larger bearish one, and a bullish harami cross if that small candle is a doji—often a prelude to a sharp reversal once price confirms by closing above the doji’s range.

To sift the highest-probability setups from noise, combine inside bars and harami signals with broader context: look for confluence at trendlines, moving-average support, or Fibonacci levels; watch volume spikes to add conviction; and use trailing stops to protect your gains while letting winners run. Remember that an inside bar or doji on its own simply marks indecision—it only becomes actionable when followed by clear directional follow-through. Practice spotting these patterns in a demo account, log each trade in a journal, and refine your entry, stop, and profit routines over time. With this disciplined, price-action approach, the inside bar strategy can become a powerful, no-nonsense tool in your trading kit—keeping you focused on what really matters: price itself.

Looking for a Broker Powered Prop Firm?

TRY AXI SELECT 100% Free Funded Trader Program

✅ First 100% Free Funded Trader Program

✅ Unrestrictive Trading - Trade News, EAs, Hold Overnight

✅ Your $500 Broker Deposit Can Be Traded and Withdrawn

✅ No Registration or Monthly Fees

✅ Earn Up to 90% of Profits, Trade up to USD $1 Million

Want to advertise with us? Get in touch