🚨 How to Trade the July FED Meeting

No interest rate changes are expected - but that doesn’t mean this meeting lacks importance. In fact, it could be one of the most consequential meetings of the year.

Hey Prop Traders, here’s are some valuable tips, terms explained and prop firm news for July 29, 2025

✂️ BEST JULY PROP FIRM DISCOUNTS

📈 PASS THE PROP TRADING TIPS

🚨 How to Trade the July FED Meeting

With inflation still running above target, tariff concerns resurfacing, and signs of economic slowdown creeping in, this week’s FOMC meeting is a pivotal moment for traders.

📍 No interest rate changes are expected - but that doesn’t mean this meeting lacks importance. In fact, it could be one of the most consequential meetings of the year.

This is the final FOMC decision before the September meeting where the Fed is expected to lower interest rates. With markets pricing in a 65% chance of a rate cut, every word from the Fed will matter. Powell’s tone, any hints about timing, and signs of division among policymakers could significantly shift expectations and spark major market moves in stocks, currencies, and bonds.

Let’s break down what to watch and how to trade it. 👇

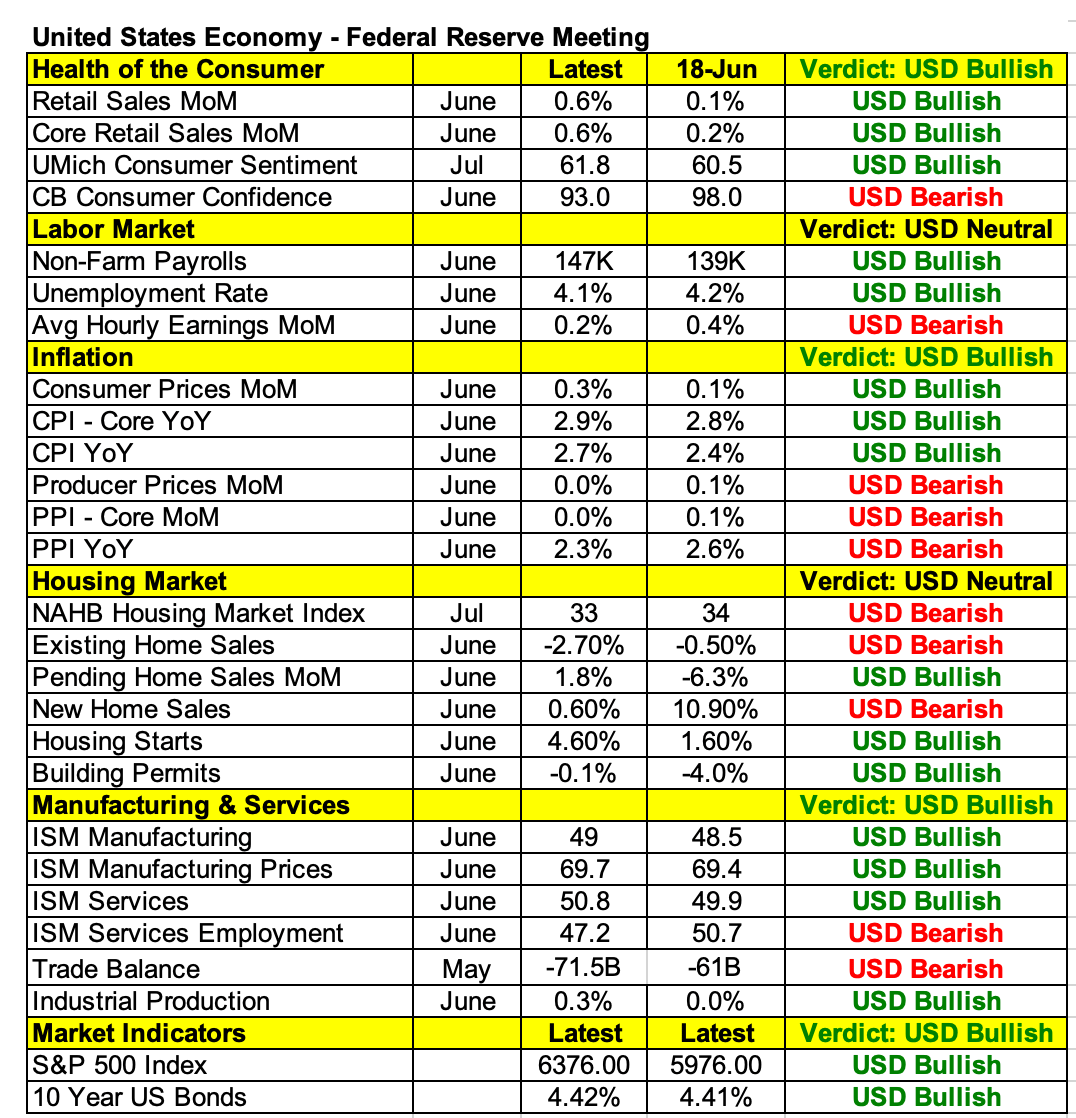

📊 How the U.S. Economy Changed Since the Last Meeting

A close look at the data since the Fed’s June 18th meeting shows a mixed picture:

✅ Consumer activity, inflation trends, and manufacturing data have generally improved, with stronger retail sales, cooling inflation, and better-than-expected ISM data—all of which support a USD bullish outlook.

❌ However, housing, wage growth, and producer prices have softened. Consumer confidence fell, wage growth slowed, and multiple housing metrics like existing home sales and builder sentiment weakened—contributing to a more dovish undertone for policy expectations.

Net takeaway: The economy isn’t flashing a clear signal. There’s been equal improvement and deterioration, which likely keeps the Fed in wait-and-see mode, reinforcing the importance of Powell’s tone and guidance at this week’s press conference.

🕑 Key FOMC Events & Timing

🔹 2:00 PM ET – FOMC Statement

Expect the Fed to keep rates on hold. But pay attention to any tweaks in the language especially around inflation, labor market conditions, and the balance of risks. Even small changes can signal a shift in policy bias.

🔹 2:30 PM ET – Powell’s Press Conference

This is the market mover. Powell’s tone and forward guidance will help shape expectations heading into the fall. Is the Fed preparing the market for a rate cut or holding back?

🔍 What Really Matters This Time

🎙️ Powell’s Guidance

The statement may be steady, but Powell’s press conference is where the real insight lies.

📌 Dovish Powell → If he emphasizes rising risks or suggests policy may need to adjust soon, it could boost stocks and weaken the dollar.

📌 Hawkish Powell → If he downplays recent concerns and stresses patience, expect a stronger dollar and pressure on equities.

🗳️ Dissent Watch

This meeting may also reveal growing tension within the Fed. If one or two policymakers vote for an immediate cut, it would be a clear sign that internal pressure to ease policy is building.

✅ A unanimous decision to hold rates would suggest the Fed is still in wait-and-see mode - dollar positive, equity negative.

✅ 1–2 dissenting votes in favor of a cut would hint at a pivot taking shape - dollar negative, equity positive.

The vote count might end up being the biggest surprise of the day.

🎯 How to Trade the Fed Decision

You’ve got three main strategies:

1️⃣ Proactive Trading 💥

If you believe Powell will lean dovish, you can position ahead of the release but be prepared for volatility at 2:00 PM ET. Consider scaling out before the initial headlines hit.

2️⃣ Reactive Trading 🕵️♂️

Wait for the statement and Powell’s initial comments. If a clear trend emerges, you can ride the momentum with a defined stop.

3️⃣ Wait for Clarity 🚫

If the market reaction is messy, there’s no harm in waiting. Often, clearer opportunities arise during the Asia or European sessions, once traders have digested the message.

⚠️ Trading with Prop Firms

Many prop firms restrict trading during major news events like FOMC announcements. That’s why it’s crucial to know the rules—or use a firm that doesn’t limit your flexibility.

👉 Axi Select allows you to trade post-FOMC volatility freely, with no consistency rules or news restrictions - so you can capitalize on the moves without worrying about penalties.

📅 What to Watch on FOMC Day

2:00 PM ET – Policy Statement

Hold + Unanimous Vote → Dollar ⬆️ / Stocks ⬇️

Hold + 1 or More Dissent for a Cut → Dollar ⬇️ / Stocks ⬆️

2:30 PM ET – Powell’s Press Conference

The tone is everything. If Powell hints at rising downside risks or suggests the Fed is nearing a policy pivot, markets will take notice—and likely move fast.

🧠 Tip: The most critical comments usually come within the first 10–15 minutes of his speech.

3:00 PM ET and Beyond – Follow-Through

By now, the market has processed the core message. Look for trend continuation or potential reversals heading into the close and into Asia.

Remember, Powell’s message and the internal dynamics of the Fed will set the tone for what could be the first rate cut in over a year.

✅ Watch for tone

✅ Watch for dissent

✅ Be ready to act—or wait for clarity

Trade smart. Trade informed. And if you’re using a prop firm, make sure it gives you the freedom to act when the real opportunity shows up.

TRADE REAL FUNDS WITH AXI SELECT & GET THEIR FREE FUNDED TRADER PROGRAM

✅ First 100% Free Funded Trader Program

✅ Your $500 Broker Deposit Can Be Traded and Withdrawn

✅ No Registration or Monthly Fees

✅ Earn Up to 90% of Profits, Trade up to USD $1 Million

🎓 PROP TRADING TERMINOLOGY

What is the Consistency Rule? 📜 DEFINITION: Some prop firms have a consistency rule that states no single trading day can make up more than a certain percent of your total profit. This percentage varies by firm and can range from 30% to 45% 📊

Example: Let's say you're a trader at XYZ Proprietary Trading Firm, and they have a consistency rule where no single trading day can make up more than 40% of your total profit.

Here's an example to illustrate how this rule works:

Suppose your total profit for the week is $10,000.

According to the firm's rule, no single trading day can contribute more than 40% of this total profit.

• Monday: You make $4,000 in profit. 💰

• Tuesday: You make $3,000 in profit. 💰

• Wednesday: You make $2,000 in profit. 💰

• Thursday: You make $500 in profit. 💰

• Friday: You make $500 in profit. 💰

Now, let's calculate the percentage of profit each day contributes to the total profit:

• Monday: $4,000 / $10,000 = 40% 📈

• Tuesday: $3,000 / $10,000 = 30% 📈

• Wednesday: $2,000 / $10,000 = 20% 📉

• Thursday: $500 / $10,000 = 5% 📉

• Friday: $500 / $10,000 = 5% 📉

In this example, no single trading day exceeds the 40% limit set by the firm's consistency rule.

However IF you make $6000 one day and only $1000 the following days, the consistency rule will be breached and you will not pass the challenge. ❌

Looking for a Broker Powered Prop Firm?

TRY AXI SELECT 100% Free Funded Trader Program

✅ First 100% Free Funded Trader Program

✅ Unrestrictive Trading - Trade News, EAs, Hold Overnight

✅ Your $500 Broker Deposit Can Be Traded and Withdrawn

✅ No Registration or Monthly Fees

✅ Earn Up to 90% of Profits, Trade up to USD $1 Million

Want to advertise with us? Get in touch