RSI vs. Stochastic: Choose the Right Indicator for Prop Trading

RSI and Stochastic are two of the most popular tools for this decision, but they work very differently.

Hey Prop Traders, here’s are some valuable tips, terms explained and prop firm news for July 24, 2025

✂️ BEST JULY PROP FIRM DISCOUNTS

📈 PASS THE PROP TRADING TIPS

RSI vs. Stochastic: Choose the Right Indicator for Prop Trading

You're watching price action unfold and need to decide: buy, sell, or wait? RSI and Stochastics are two of the most popular tools for this decision, but they work very differently.

How They Work

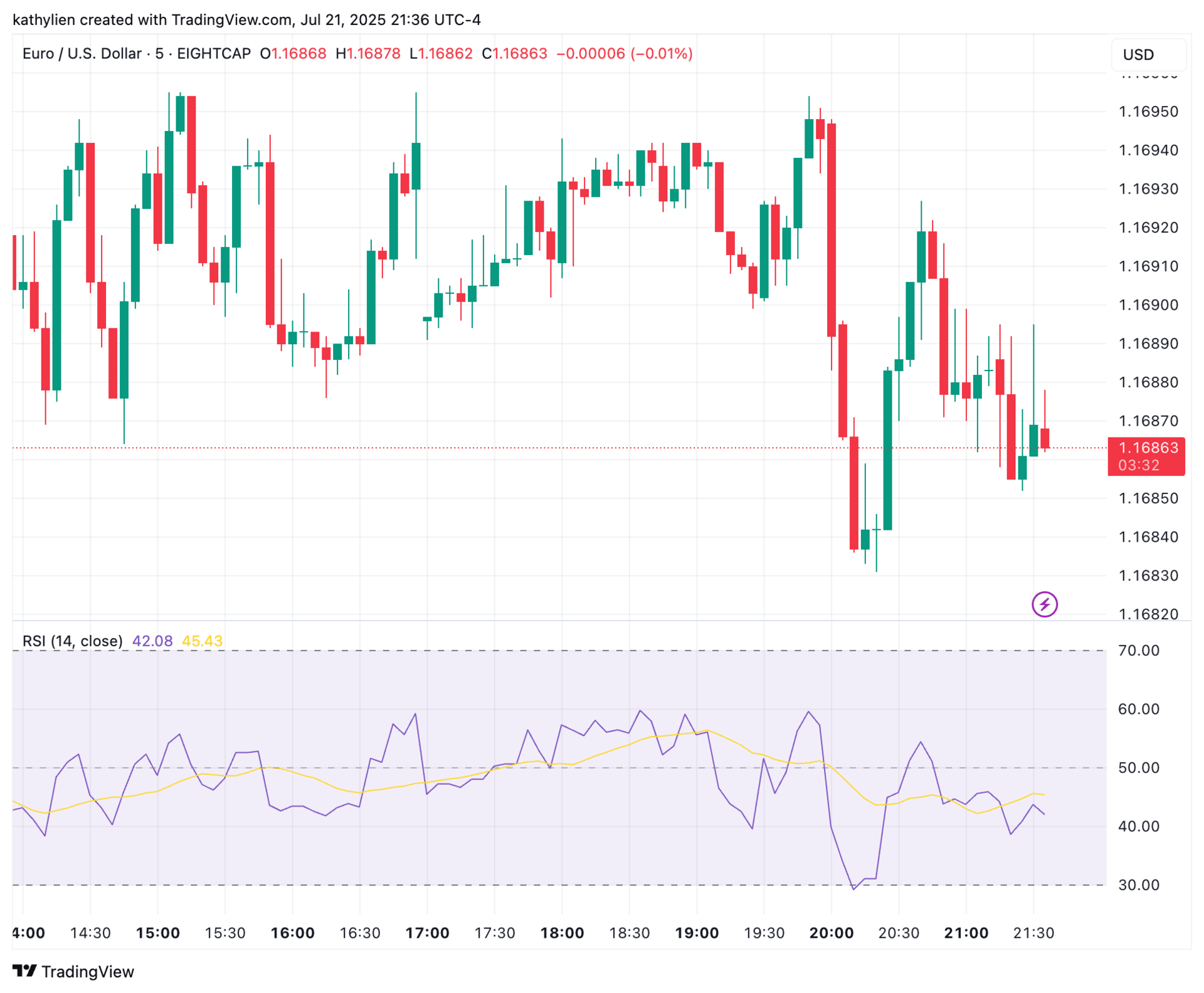

RSI measures velocity - how fast and far price is moving. It compares average gains to losses over 14 periods, oscillating between 0-100. Above 70 suggests overbought conditions, below 30 indicates oversold. Think of it as a momentum speedometer.

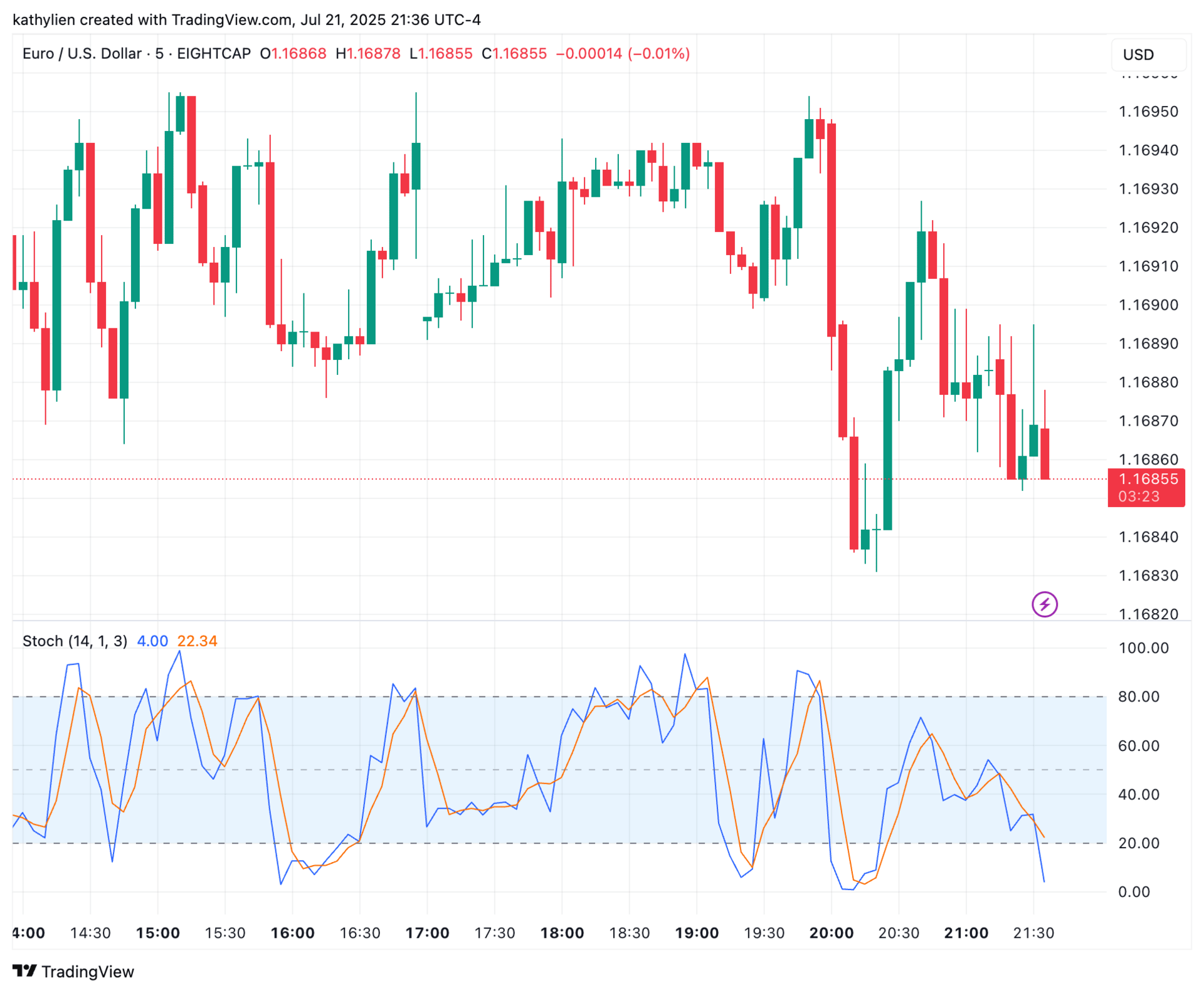

Stochastics measures position - where the current price sits within its recent range. It compares today's close to the high-low range over a lookback period, creating two lines (%K and %D). Above 80 is overbought, below 20 is oversold. It's essentially asking: "Are we near the ceiling or floor of recent trading?"

The Key Difference: Sensitivity and Signal Frequency

Stochastics is highly sensitive, generating frequent signals. In a typical trading day, you might see 8-12 signals on a 5-minute chart. Great for hitting daily profit targets quickly but prone to false alarms that can eat into your account.

RSI is smoother and more conservative, producing fewer but typically more reliable signals - perhaps 3-5 quality setups per day. This measured approach aligns well with prop firm risk management requirements.

When to Use Each

Use RSI for:

Trending markets (handles sustained moves without premature exits)

Swing trading on funded accounts (4H-Daily timeframes)

Building consistent track records for prop firm evaluations

Managing larger position sizes (cleaner signals reduce position sizing errors)

Meeting monthly profit targets through steady, reliable trades

Use Stochastics for:

Range-bound markets (excels at catching support/resistance bounces)

Intraday scalping (1-15 minute timeframes)

Aggressive daily profit target strategies

High-frequency trading approaches

Maximizing opportunities during slow market periods

Neither is inherently "better" - it depends on your trading style and market conditions. Day traders often prefer Stochastics for responsiveness, while position traders favor RSI's reliability.

Your choice depends on your prop firm's rules and your personal risk tolerance. Firms with strict daily loss limits might favor RSI's conservative approach, while those emphasizing profit generation might reward Stochastics' active signal frequency.

Pro tip: Many successful prop traders use both together - Stochastics for precise entry timing, RSI for overall market direction and exit strategy. When both align, trade probability increases significantly, which is crucial when trading someone else's capital.

Choose based on:

· Your timeframe (shorter = Stochastics, longer = RSI)

· Market type (trending = RSI, ranging = Stochastics)

· Signal preference (frequent = Stochastics, selective = RSI)

The best indicator is the one that helps you pass evaluations, stay funded, and scale to larger account sizes consistently.

Remember: Prop firms want consistent performers, not cowboys. Match your indicator choice to your firm's success metrics, and let the profits follow.

Looking for a Broker Powered Prop Firm?

TRY AXI SELECT 100% Free Funded Trader Program

✅ First 100% Free Funded Trader Program

✅ Unrestrictive Trading - Trade News, EAs, Hold Overnight

✅ Your $500 Broker Deposit Can Be Traded and Withdrawn

✅ No Registration or Monthly Fees

✅ Earn Up to 90% of Profits, Trade up to USD $1 Million

Want to advertise with us? Get in touch