The Gold Market Risk No One Sees Coming This Week

Yen intervention could trigger sharp gold spikes this week, creating major risk for prop traders.

The Gold Market Risk No One Sees Coming This Week

Gold traders spend most of their time tracking U.S. inflation reports, Federal Reserve policy shifts, geopolitical shocks, and equity market flows. But this week, the biggest catalyst for gold may come from somewhere most traders aren’t even looking: Japan’s potential intervention in the yen.

If that sounds like a currency story, not a gold story - think again. Yen intervention has repeatedly triggered some of the fastest and most powerful gold spikes of the year, and we are heading straight into one of the highest-risk intervention windows on the calendar.

Here’s why gold traders should not overlook this.

Why a Japan Intervention Is a Gold Event, Not Just a Forex Event

When Japan intervenes in the currency market, they perform a massive two-sided operation:

They buy yen,

And they sell U.S. dollars aggressively

That second part is critical.

Gold is priced in dollars. A surge of forced dollar selling, especially in thin liquidity, can produce an instant upward shock in gold. It’s not gradual. It’s not technical. It’s not a macro trend. It's pure order flow pressure.

Within seconds, gold can launch $20 to $40 because of the dollar collapse that intervention creates.

Japan Has Been Signaling Intervention… Again

Over the past several days, Japanese officials have ramped up the exact language they’ve used before past major interventions:

“Prepared to respond appropriately to excessive moves.”

“We will not rule out any options.”

“FX moves have become rapid.”

These were the same warnings issued in April, May and July of 2024 - the days of those massive 400–500 pip USDJPY crashes.

History is repeating.

And USDJPY is back near intervention territory.

Proof: Each Intervention Triggered a Gold Spike

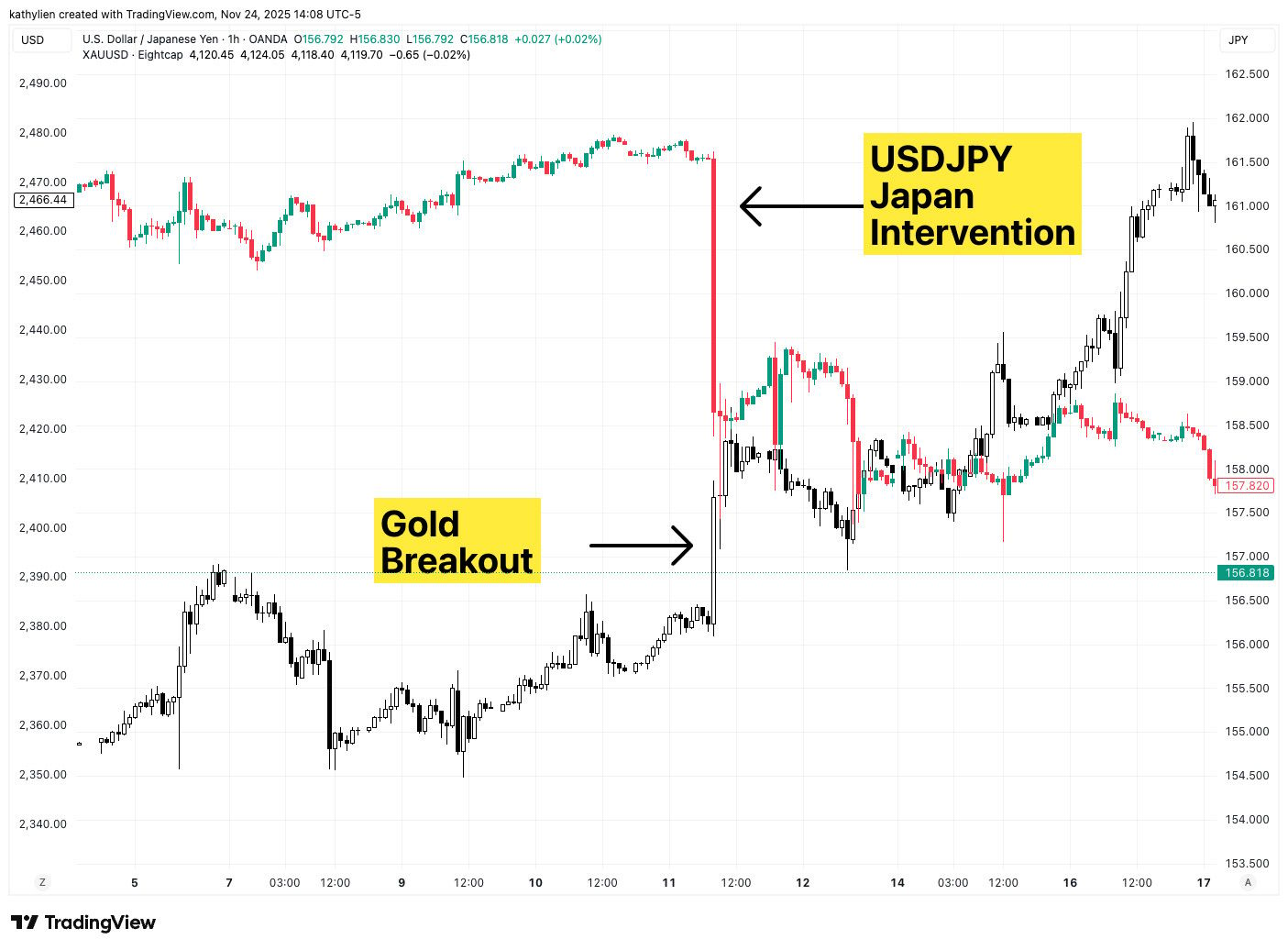

This chart shows how gold broke higher when the Japanese government last intervened in July.

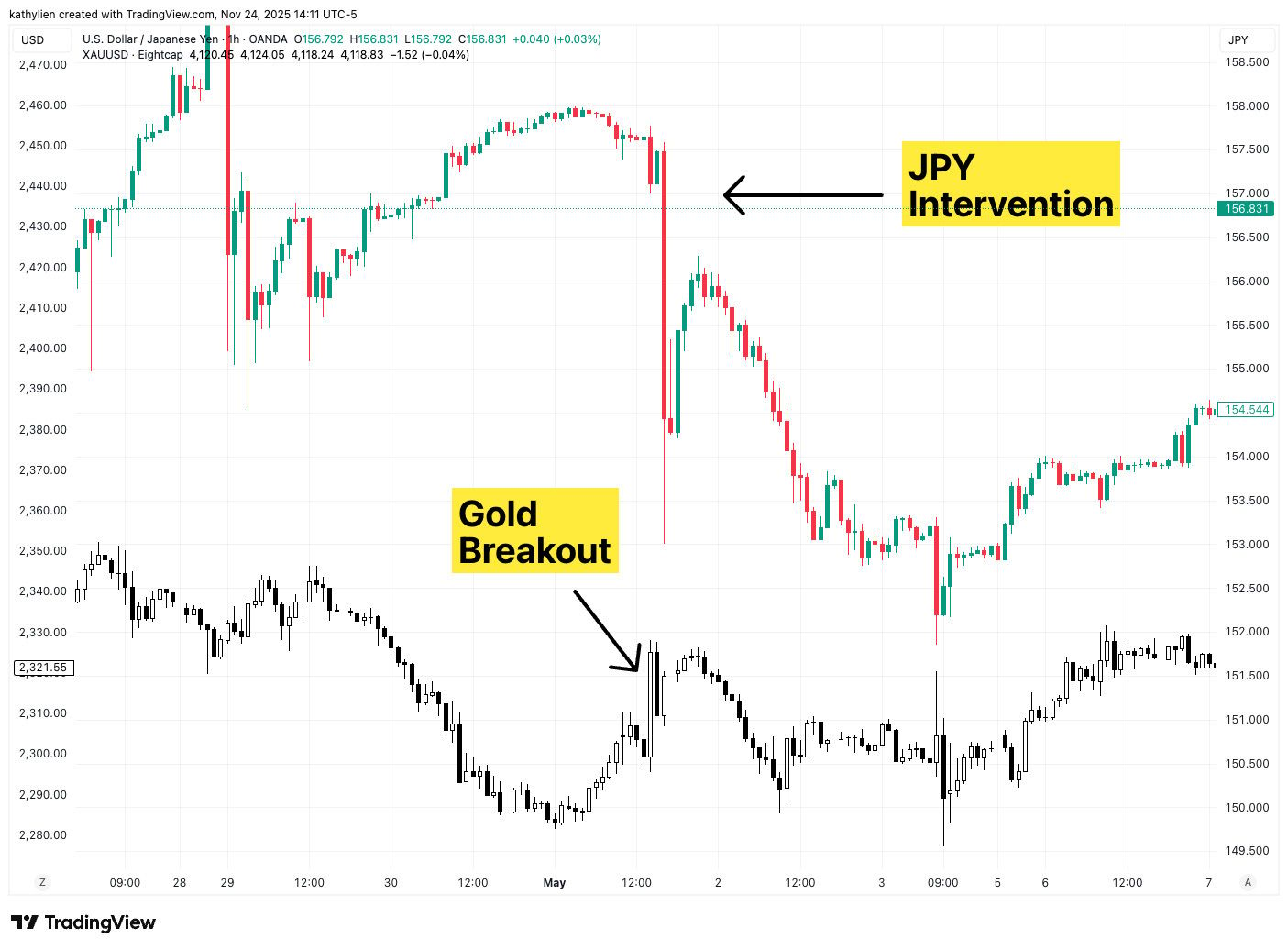

This chart shows similar price action in May of 2024. Gold also rallied in April after intervention but the move was in a matter of hours not minutes.

In each case:

USDJPY collapsed hundreds of pips within minutes

Gold spiked sharply, roughly at the same time

The move was fueled by the wave of USD selling

These were some of the fastest metal moves all year yet most gold traders weren’t watching USDJPY at all.

Why This Week Is Especially Dangerous

This week is not business as usual.

The U.S. Thanksgiving holiday creates one of the lowest-liquidity periods of the entire quarter. Markets thin out Wednesday night. They thin out even more on Thursday. And Friday is a half-day.

Japan knows this.

They prefer intervention during:

Holiday sessions

Low liquidity

Thinned global volume

Hours when USD selling has maximum shock value

Which makes Wednesday night through Friday the highest-risk window for a surprise strike.

This is the risk gold traders and crypto traders aren’t seeing coming.

Why Prop Traders Must Be Extra Careful

For prop traders, a surprise yen intervention is not just a volatility event, it’s a drawdown threat.

Gold can:

Spike violently

Blow through stops

Hit daily or total drawdown instantly

Trigger forced shutdowns

Cause big slippage on both sides

If you’re trading with a firm that enforces daily limits, this is a week where one unexpected headline could make or break your account.

Being aware means being prepared.

Trade Smarter During Volatile Weeks

If you want to get funded on the back of this potentially big event, here’s a list of our favorite prop firms.

ThinkCapital - Best CFD/Forex prop for U.S. traders (use code: BKSAVE)

Trade directly on TradingView, tight spreads, broker-powered, free trial.

Axi Select - The only 100% free funded trader program

No challenge fees. No time limits. Skill-based scaling.

Breakout Prop - Top crypto-only prop firm backed by Kraken

Perfect for Bitcoin, ETH, and high-volatility weeks like this. Save with code: BKSAVE

Looking for a Broker Powered Prop Firm?

First 100% Free Funded Trader Program

Unrestrictive Trading - Trade News, EAs, Hold Overnight

Your $500 Broker Deposit Can Be Traded and Withdrawn

No Registration or Monthly Fees

Earn Up to 90% of Profits, Trade up to USD $1 Million